- tradecen

- Learn to Trade

- Precious Metals Trading

Metal Trading

Historically, metals and particularly precious metals have always been perceived as a safe-haven. This is especially true in times of economic turmoil, war and political uncertainty. As such, following the financial crisis of 2008 and ahead of the US-China trade deal talks, investing in precious metals and metal trading are gaining traction once again.

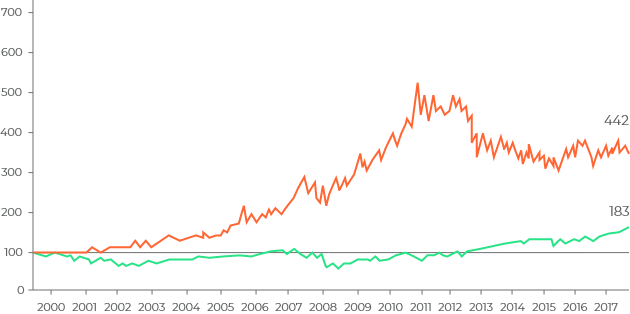

Traditionally, precious metals —particularly Gold— have been considered a safe investment. The global financial crisis of 2008 saw the stock market crash, with the Dow Jones Industrial Average (a stock market index that includes 30 of the largest US companies) falling from a level of 13,264 to 7,062. That’s a loss of 47% of its value in 15 months. However, during the same period between December 2007 and November 2008, Gold prices increased by 17%. Between 2008 and 2012, the value of Gold continued to increase dramatically as the United States struggled with the economic and financial crises of the recession, and the U.S. Federal Reserve increased its initial effort of quantitative (or monetary) easing.

- Gold Price Per Ounce

- S&P 500 Index

- Gold Price Per Ounce

- S&P 500 Index

Many financial experts recommend portfolio diversification that includes at least 10% to 20% (and sometimes more) of tangible assets such as Gold, Silver, Platinum and Palladium bullion and bullion coins. In today's uncertain political and economic environment, many reputable brokers offer metals trading as a way to diversify their clients’ portfolio.

Precious Metals Trading

Precious metals are valuable metals, which are rare and occur naturally. They have wide commercial and industrial applications and high economic value. Their use as investment instruments makes precious metals the objects of intense speculation in the commodity markets. Precious metals trading capitalises on these commodities as a form of money that holds its value better than printed paper money.

Precious metal trading focuses on four primary metals, which are: Silver (Ag), Gold (Au), Platinum (Pt) and Palladium (Pd). The scarcity of and demand for these precious metals make them more valuable than base metals. There are secondary market metals among the different precious metals that can act as a buffer should the Gold, Silver or Platinum price dips below performance standards. These secondary market products usually carry lower premiums and lower risk – but, as with all financial instruments, are by no means a ‘safe’ investment.

The variety of precious metals to invest in gives traders access to a product that has historically rebounded quickly.

However, there are important factors that an investor must understand to potentially succeed at precious metals trading. Namely, the way that the precious metals market differs from the stock market.

Stocks traded on the stock market are equities where stockholders own a small or large portion of the company whose stocks they trade. Precious metals are commodities. Investors either hold a physical metal product or make money from the difference in the buy and sell price of the metal when the demand for the metal increases and spot prices rise.

The stock and precious metals markets exist and function independently of each other. Historically, precious metals markets move in the opposite direction of the stock market. This correlation gives investors a viable option should the stock market crash.

There are several ways to invest in precious metals. You can either purchase the physical metal in the form of bullion bars and bullion coins, or you can opt for financial products such as stocks, futures, options, mutual funds and exchange-traded funds based on precious metal holdings (ETFs).

Commodity ETFs

Exchange-traded funds are available for all precious metals. They offer a convenient and liquid means of purchasing and selling Gold, Silver or Platinum. When investing in ETFs, you don’t actually own the metal. ETF investors have no claim on the gold within the fund and cannot take delivery of the metal if the need arises. However, you can profit tremendously from the movement of spot metals prices.

Common stocks and mutual funds

Shares of precious metals mining companies are leveraged to price movements in the precious metals. It is recommended to know how these mining stocks are valued, as well as to keep track of company performance records.

Futures and options

The futures and options markets offer liquidity and leverage to investors who want to speculate the price of Gold vs USD, Gold vs EUR or other pairs. The greatest potential profits and losses can be had with derivative products.

Bullion

When you invest in coins and bars, you purchase the physical metal in the form of bullion bars or bullion coins. However, bullion is considered illiquid and a bit bothersome to hold.

Certificates

Certificates offer investors all the benefits of physical gold ownership without the hassle of transportation and storage. However, in the event of a real disaster, certificates are just paper and can’t be exchanged for anything of real value.

Precious metals trading has several major benefits in that it provides unique inflationary protection. As precious metals have intrinsic value, they carry no credit risk and therefore cannot be inflated. There is a genuine “insurance” against financial or political/military upheavals.

From a trader’s perspective, precious metals also provide a low or negative correlation to other asset classes such as stocks and bonds. Even a small percentage of precious metals in your portfolio is sufficient to reduce both volatility and risk as they can offer outstanding price appreciation and profit potential.

Spot Gold Price

The current (daily) price of Gold is known as the spot gold price. It is the price of Gold at the time of the trade or transaction as opposed to a date in the future. The spot price for Gold is in a constant state of fluctuation and can be driven by many factors. Typically, the spot Gold is quoted in price per ounce using U.S. Dollars. Quotes are also available depicting the spot Gold price in other currencies as well.

The value and therefore the price of gold is determined by the market 24 hours a day, seven days a week. Gold trades predominantly as a function of sentiment, which means its price is less affected by the laws of supply and demand. The actual spot price of Gold is derived from the nearest month Gold futures contract with the largest volume. This could be the nearest month or front month, or it could be a month or two out on the time horizon.

As the main precious metal, Gold usually sees stronger investment demand during periods of economic or geopolitical stress. Between early April of 2001 and early September of 2011, spot Gold increased from a low of approximately $250 per ounce to a high of nearly $1,900 per ounce — an increase of over 600% in about 10-1/2 years. Interest rates and monetary policies can also have a significant effect on the spot Gold price. Gold may produce impressive short-term investment returns as well during periods of ultra-low interest rates, as low rates make the opportunity cost of holding Gold less.

Spot Metals

Spot metals trading consists of exchanging a spot metal — Gold or Silver — for a currency. For example, a trader might choose to trade Gold against the British Pound (XAUGBP) or Silver against the Euro (XAGEUR).

Part of potential successful spot metals trading is staying up-to-date with the metals markets by monitoring the performance of some main indices that track the sector. There are numerous spot metals indices that provide good basis for investment demand in the sector since they measure the performance of metals futures, such as The S&P GSCI Precious Metals Index, The S&P GSCI Industrial Metals Select, the UBS Bloomberg CMCI Industrial Metals Index Total Return and the DBIQ Optimum Yield Industrial Metals Index Excess Return.

Additional resources on market pricing and news on both the precious and base metals sectors are also available for investors. Using spot metal price charts for monitoring Gold and Silver spot prices is also recommended to keep track of market movements.

The trading of spot metals represents an opportunity for investors and traders to diversify their financial holdings to ensure they are at least partially represented on the safe-haven scene. Some regulated brokers like Patriotpeak Capital offer additional instruments like Contracts for Difference (CFDs), where they can take either long or short positioning on Gold and Silver. CFDs allow traders to speculate on the price of metals without having to purchase shares, ETFs, futures or options. Customers deposit funds with the broker, which serve as margin. The value of a CFD comes from the difference between the price of metals at the time of purchase and the current price.

Ongoing uncertainty in the financial markets is part of what drives the demand for the trading of spot metals. Precious metals are usually quite effective against the depreciation of fiat currencies, and since they have intrinsic value, they are not valued just as a medium of exchange. Spot metals are thus becoming increasingly popular with traders around the world. In times of great market uncertainty, people often tend to turn to the security of precious metals, with Gold and Silver perceived to be an excellent inflation hedge. Like all other instruments in the financial markets, political and economic events can significantly influence the price of spot metals and cause their values to fluctuate.

Spot Metals Prices

Spot metals prices or the spot price of any metal refers to the price at which certain metals may be exchanged and delivered at the current moment. In other words, the spot price is the price at which Gold, Silver, Platinum or any other metal is currently trading. Spot prices are often referenced in the Silver and Gold markets, as well as crude oil and other commodities.

As spot metals prices are in a constant state of discovery, they are the focus of interest of banks, financial institutions, brokers and retail investors. Since the beginning of the 21st Century, spot metal prices have increased overall, catching the attention of many investors. Many people have turned to precious metals, such as Silver, Gold and Platinum, to help protect themselves against the ongoing devaluation of the U.S. Dollar (or other fiat currencies) and volatility in the stock market.

With this in mind, every investment comes with its own set of risks. Although spot metals come with a certain degree of security, there is always some risk that comes with precious metals trading. Spot metals prices are known to fluctuate frequently and can drop during times of economic stability, putting a damper on things for people who like to invest heavily in the precious metals market. Selling may be a challenge during times of economic volatility, as prices tend to rise quickly.

Overall, the deep liquidity and high volatility of spot metals mean positions may be easily opened and plenty of opportunities arise whether the precious metal’s price is rising or falling.

Investing in precious metals has been a popular way for people to preserve their wealth even before the stock market existed. Usually, precious metals are viewed as long-term investments due to their intrinsic value, which has helped them to retain a long track record as investment instruments. However, trading precious metals based on social and political factors, combined with the supply and demand of the metals, is another lucrative option and one that can cushion your losses on the stock market if need be.

One of the main advantages of trading precious metals is that spot metal Forex brokers help traders to add diversity to their investment portfolio with different investment instruments. By diversifying your investment portfolio, you can freely move from one asset to another. You get the opportunity to safely enter the trading world, without risking major financial losses from all elements. With multiple types of assets, there is the possibility to expand their investments on different trading instruments without putting “all your eggs in one basket.”

The precious metals market can be extremely volatile so it might not be suitable for all investors. It is, however, well-suited for traders who are interested in commodities such as gold and silver, and who want to purchase precious metals as part of a diversification strategy.

Familiarising yourself with the spot market price charts, analysis, and market reviews will help you make an informed decision about your portfolio diversification strategy and give you a competitive edge in the precious metals market.

-

About Us

-

Copy Trading

-

Learn to Trade

-

Promotions